student loan debt relief tax credit application 2021

In either the 2020 or 2021 tax. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Before calling your loan provider to request your refund you need to know your account number and the amount you want refunded.

. The site outlined that in 2021 close to 9000 residents of Maryland applied and received the tax credit. September 23 2022 158 PM 11 min read. However the loan forgiveness element does not apply to private student loan borrowers who account for an estimated 8 of total outstanding student loan debt in the US.

How to apply for Marylands student loan debt relief tax credit. For unsafe financial obligations such as credit cards individual car loans particular personal trainee loans or other similar a financial debt relief program might offer you the service you. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit.

Get details about one-time student loan debt relief. Ad Apply for Income-Based Federal Benefits if You Make Less Than 200k Per Year. For tax financial debt relief CuraDebt has an incredibly professional group resolving tax financial obligation issues such as audit defense complicated resolutions offers in concession deposit.

But the state offers a Loan Debt Relief Tax Credit for. 2 days agoUse our student loan forgiveness calculator below to see if you qualify for loan forgiveness and how much of your debt could be canceled. It was founded in 2000 and has since become a.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Amounts canceled as gifts bequests devises. By the end of 2021 Kentucky had a student loan d.

Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over. Mhec student loan debt relief tax credit program for 2021. Final extension of the student.

There are a few qualifications that must be met in order to be eligible for the 2021 tax credit. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application.

How to apply for the Maryland Student Loan Debt Relief Tax Credit. The latest Student loan Debt relief. 31 2023 to apply.

The biting GOP pushback to President Joe Bidens student loan forgiveness program has some wondering if the student debt deal. 2 days agoIn Texas 52 of college graduates in the 2019-20 school year had taken on student loan debt with an average debt of 26273 according to The Institute for College Access. Have incurred at least 20000 in undergraduate andor graduate student loan.

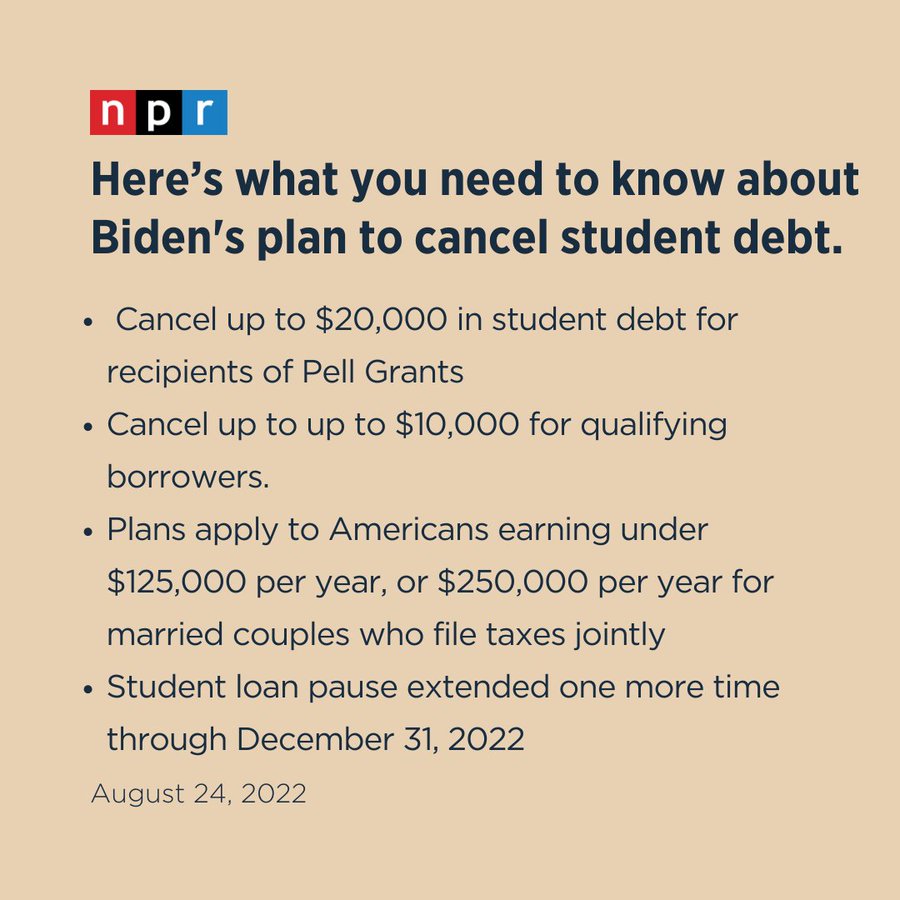

2 days agoIt no doubt came as a relief to many of these borrowers when on Aug. That it application in addition to relevant directions try to possess Maryland people just who wish to allege new Student loan Debt settlement Taxation Credit. 24 2022 President Biden announced a three-part student loan forgiveness plan to eliminate student.

About the Company Student Loan Debt Relief Tax Credit Application 2021 CuraDebt is a debt relief company from Hollywood Florida. Ad Use our tax forgiveness calculator to estimate potential relief available. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

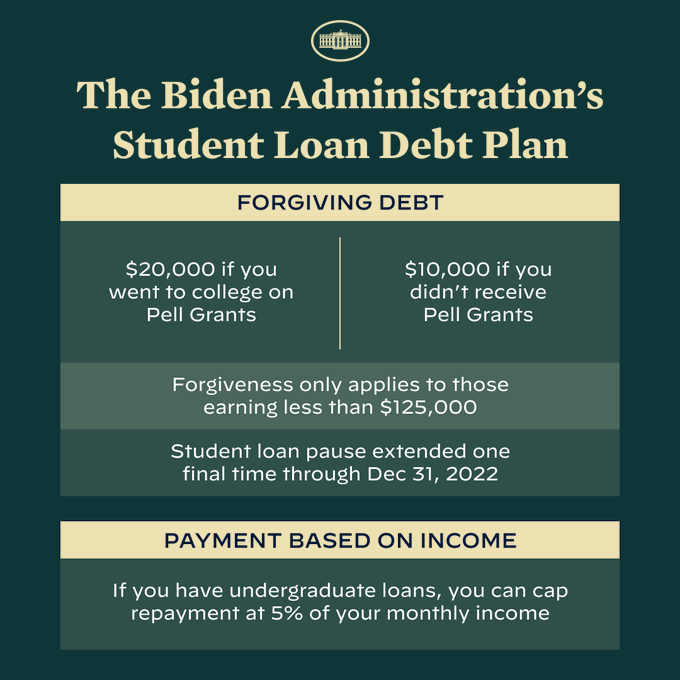

It was established in 2000 and is a part of the. The Biden Administrations Student Loan Debt Relief Plan Part 1. About the Company Student Loan Debt Relief Tax Credit Application.

If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loansThe state is offering up to 1000 in tax credits for student loan. Apply For Tax Forgiveness and get help through the process. 1 day agoAn application to receive the benefit is expected by early October.

CuraDebt is a company that provides debt relief from Hollywood Florida. One begins to lose rest and feels pressured. Youll have until Dec.

Loan servicers phone numbers. President Biden Vice President Harris and the US. Department of Education have announced a Student Debt Relief plan that allows eligible borrowers to receive up to 20000 in federal.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Find Your Path To Student Loan Freedom. Ad Use our tax forgiveness calculator to estimate potential relief available.

Maryland Adjusted Gross Income.

Prodigy Finance Review International Student Loans International Student Loans Refinance Student Loans Millennial Personal Finance

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Debt Relief Am I Eligible For Loan Forgiveness How Much Is Canceled How Do I Apply Cnet

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Biden Student Loan Forgiveness Relieves 10 000 In Debt Double For Pell Grants Bloomberg

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

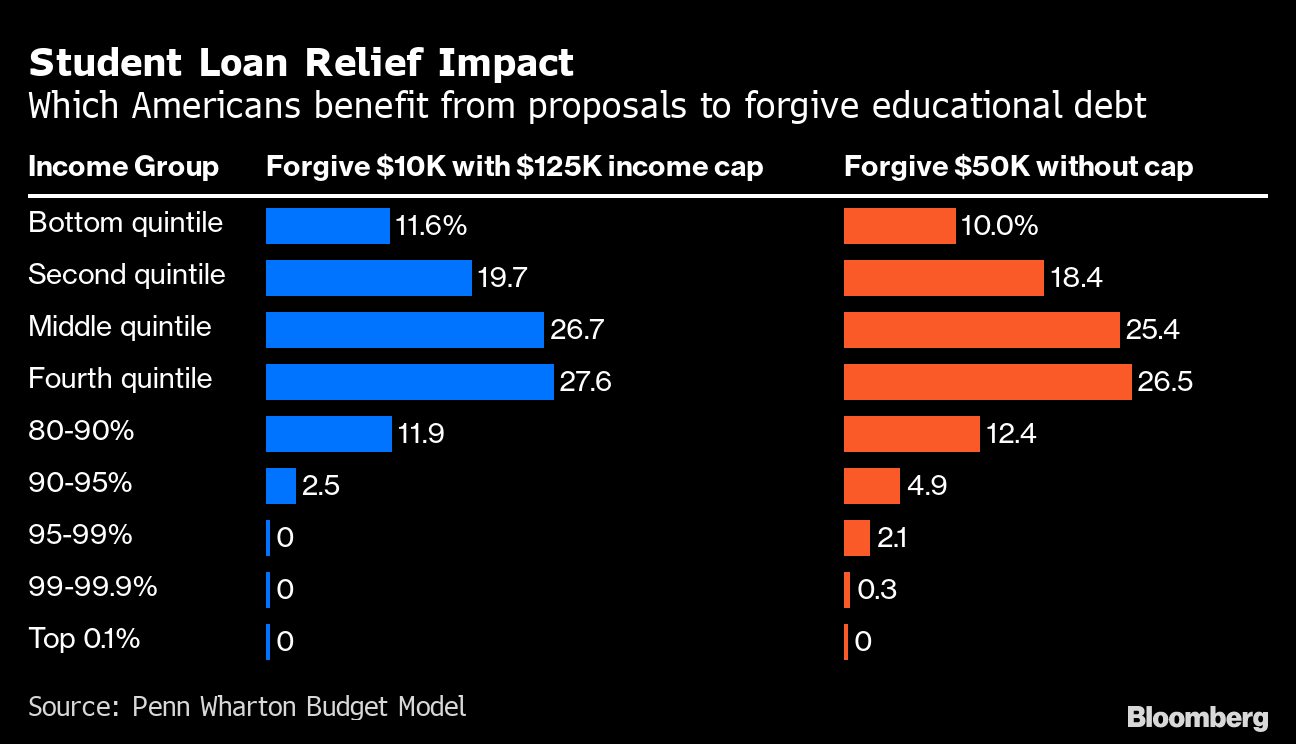

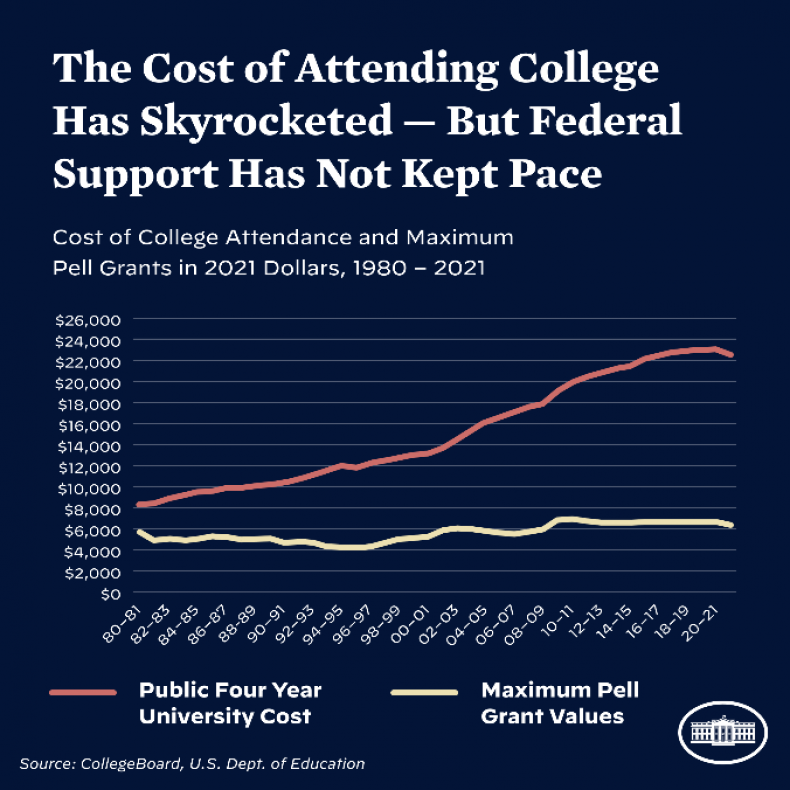

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Student Loan Forgiveness Statistics 2022 Pslf Data

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Biden To Cancel Up To 10k In Student Loan Debt For Borrowers Making Under 125k Npr

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Biden S Student Loan Forgiveness Announcement Wednesday What To Expect Bloomberg

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

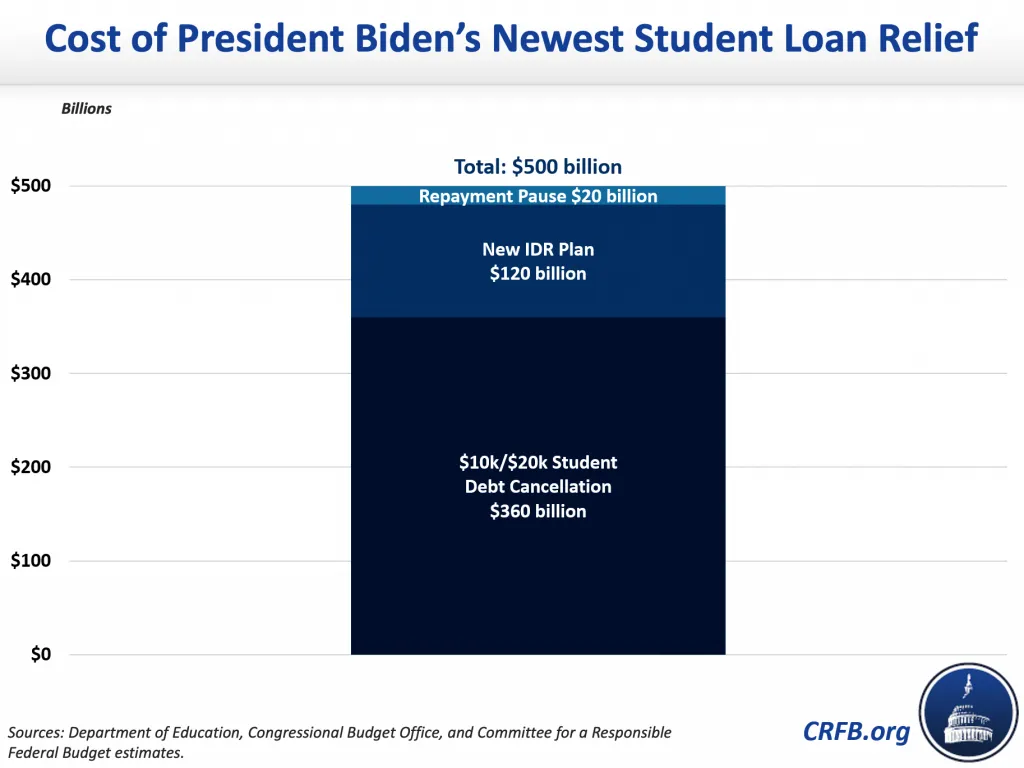

New Student Debt Changes Will Cost Half A Trillion Dollars Committee For A Responsible Federal Budget

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers